Exness Multi Asset Broker in Saudi Arabia

A reliable option available for every trader in Saudi Arabia is Exness. It is a multi-asset broker and provides numerous financial markets to trade. Well, this ranges from forex to stocks, indices and even crypto. Exness takes their security seriously and offers different types of accounts making it a comfortable environment for a beginner as well as an experienced trader.

Exness Overview

Exness is a renowned global broker with a well established solid reputation in the industry. Exness, which was established in 2008, is a global forex and CFD broker, offering trading in forex, stocks, indices, metals and crypto. Apart from this, the brokers are regulated from the authoritative financial bodies ensuring a secure trading platform.

You can access trade from Exness anywhere from all devices including MetaTrader 4, MetaTrader 5 and a mobile app as well. Exness — with low spreads, fast transactions and supporting customers 24/7 in multiple languages (Arabic included), it has become a popular choice for the worldwide traders

Why Traders in Saudi Arabia Choose Exness

Exness is a great option for Saudi traders who want to trade with a broker that is easy, safe, and has many options. Exness gives you access to different markets including forex, stocks, metals and cryptocurrencies. This diversity gives options to the traders to diversify it further as we can also invest in various assets to dilute the risk better.

Here are some top reasons why Saudi traders prefer Exness:

- Regulated and Safe: Exness is regulated by trusted authorities, ensuring security.

- Flexible Account Options: There are accounts for beginners, experienced traders, and those needing a Sharia-compliant option.

- Leverage Choices: Traders can choose high leverage on some assets, allowing them to manage more funds.

- Easy Payment Methods: With options that work locally and internationally, deposits and withdrawals are simple.

In short, Exness is an ideal choice for Saudi traders looking for a flexible, affordable, and secure trading platform.

Exness Content Overview

- Exness Overview

- Regulation and Security of Exness

- Types of Accounts at Exness

- How to Open an Account with Exness

- Exness Trading Platforms

- Trading Instruments and Markets

- Spreads, Commissions, and Leverage

- Deposits and Withdrawals

- Exness Social Trading

- Customer Support in Arabic

- Exness Reviews and Reputation

- Is Exness a Reliable Broker?

- Advantages and Disadvantages of Exness

- Frequently Asked Questions

Regulation and Security of Exness

Exness is a regulated broker and therefore has to comply with rules to protect traders. With authorities such as CySEC and the FSA regulating Exness, they need to adhere to strict requirements regarding security and transparency. In turn, this guarantee of the safety of clients’ funds and the fair operation of the broker.

Exness segregates traders funds keeping them in separate accounts apart from the company money to ensure safety. That means clients will be safeguarded no matter what happens to the broker. Traders are also protected against negative balance at Exness, meaning you cannot lose more money than you have in your account. Audits conducted by trusted firms regularly promote transparency and a higher level of security.

Is Exness Legal in Saudi Arabia?

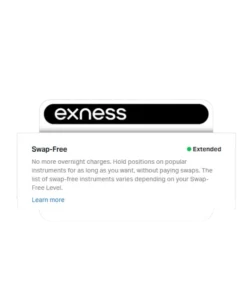

Yes, Exness is legal in Saudi Arabia. Exness itself does not have a license from a Saudi regulator, but it is license-free and works with international licenses and regulations, so for all intents and purposes, it operates in Saudi Arabia safe and legal. In addition, Exness also has a swap-free account or Islamic account option as well.

Your account type is built to be sharia-compliant, meaning there is no charge of interest on overnight trades. Thus, Exness is a good option for Muslims who wish to trade in accordance with the tenets of Islamic banking.

Types of Accounts at Exness

Exness has multiple account types for every trading requirement. There is something for every level of trader, from novices to advanced. All accounts come with tailored characteristics, minimum deposits, and costs, meaning traders can opt for the most suitable one for their strategy. Here is a brief table outlining the main aspects of each account type.

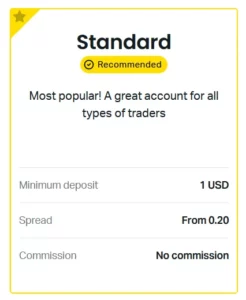

Standard Account

The Standard account caters for all types of traders from novices to experts. The minimum deposit is only $1 and spreads start from 0.3 pips. The absence of commission fees makes this option ideal for a majority of trading strategies.

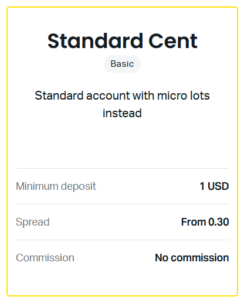

Standard Cent Account

Standard Cent account is suitable for newcomers as it allows practice with minor funds. Similar to the Standard account it comes with a minimum deposit of $1 however trade denominations are in cents instead of dollars. So this gives the trader a chance to try the strategies with very little risk.

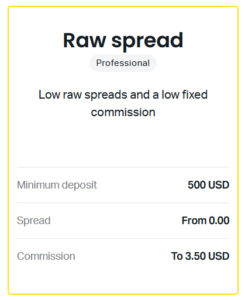

Raw Spread Account

The Raw Spread account is for the advanced trader who wants very low spreads. Suitable for scalping and short term strategies with spreads from 0.0 pips on the same account. Of course, this comes with a service charge which is $3.5 per lot at a minimum and a minimum deposit of $500.

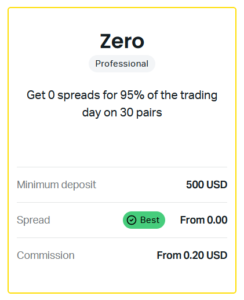

Zero Account

The Raw Spread account is for the advanced trader who wants very low spreads. Suitable for scalping and short term strategies with spreads from 0.0 pips on the same account. Of course, this comes with a service charge which is $3.5 per lot at a minimum and a minimum deposit of $500.

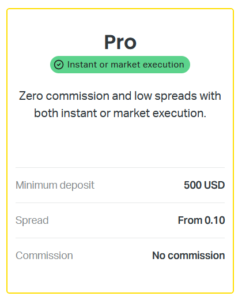

Pro Account

Pro is aimed at professional traders looking for an equilibrium between cost and spreads. Offering low spreads from 0.1 pips with no commission based on a $500 low deposit, this is an ideal advanced flexible option.

Islamic Account (Swap-Free)

The Islamic (Swap-Free) account is available for traders who follow Sharia law. This account type removes interest charges on overnight positions, allowing Muslim traders to trade without violating Islamic finance principles. It’s available on several account types, making it adaptable to different trading needs.

Demo Account

Demo account enables traders to explore Exness functions and practice with no risk. Their minimum deposit requirement is none to minimal, and traders can test strategies, platforms, and improve their skills by using virtual funds before trading real money.

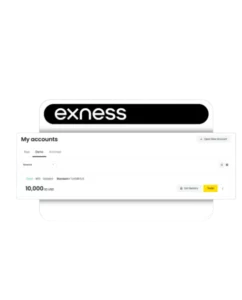

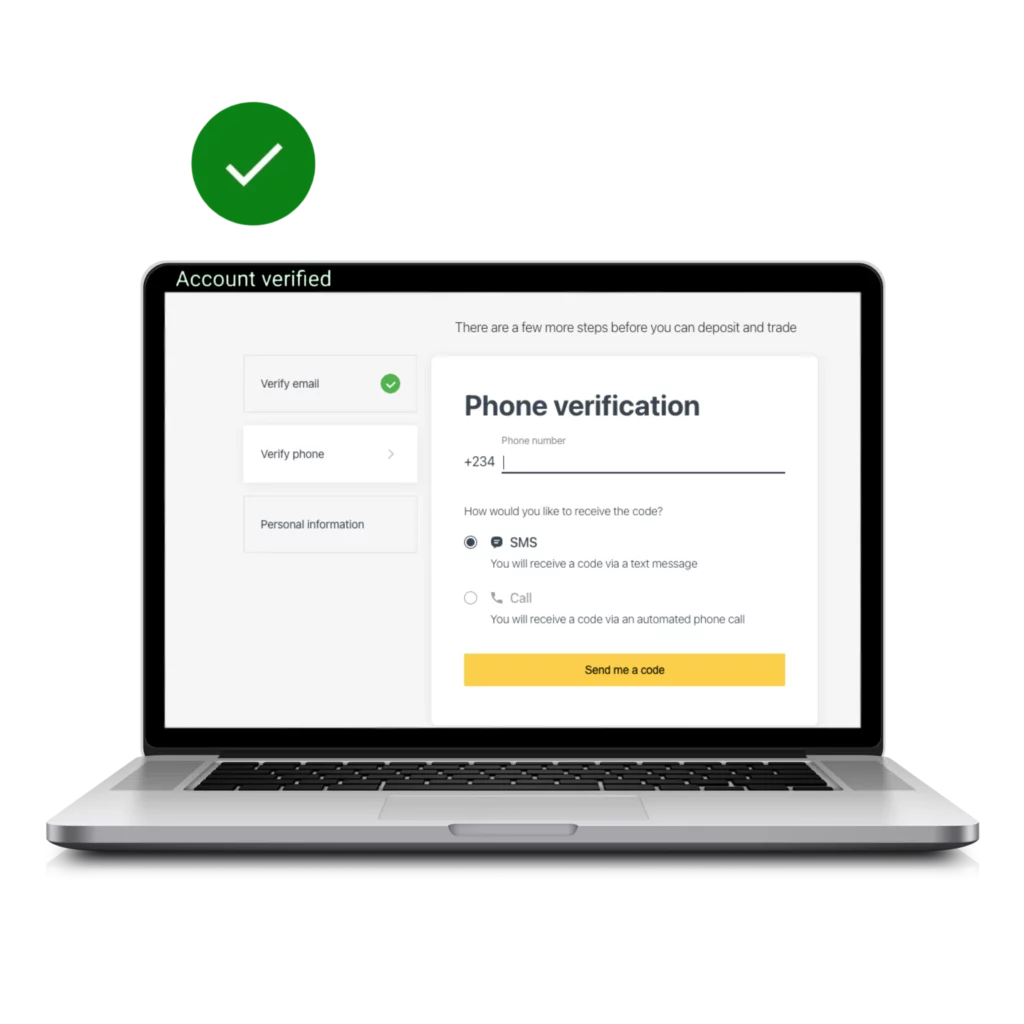

How to Open an Account with Exness

Exness account creation is the same as registration and passing few processes to log into your personal area to verify the account. Every single step is being described here to make the process quick and safe.

Registration

- Visit Exness website and click on Open Account.

- Fill in your name, email and password

- Confirm your email address by opening the confirmation email from Exness and clicking the link.

Login to the Exness Personal Area

- After registration, go back to the Exness website and click on “Login.”

- Enter your registered email and password to access your account.

- Once logged in, you can access the personal area, where you can deposit funds, select a trading platform, and manage your account settings.

Verification

- In the personal area, go to the verification section and upload a valid ID, such as a passport or national ID card.

- Provide proof of address by uploading a recent document, like a utility bill or bank statement.

- Wait for Exness to review your documents. Once approved, your account will be fully verified, and you’ll have complete access to all trading features.

Exness Trading Platforms

Exness offers several trading platforms that cater to different needs and trading styles. Each platform is designed to give traders flexibility and control over their trades. Some platforms are suited for desktop use, while others are perfect for trading on the go. Here’s a quick overview of what each platform offers.

MT5 is the updated edition of MT4 and offers extra features. It allows the traders to also utilize various order types, which is required for flipping complicated trades. It also includes a larger array of charting and analysis tools, and not only supports forex, but also a wider range of asset classes including stocks and indices. Ideal for those traders who need more control and flexibility in their trading.

MT5 is an advanced version of MT4 and has some additional functionalities. This provides traders the ability to place additional order types, aiding in complex trade management. MT5 offers advanced charting features and allows more types of assets to be traded including stocks and indices as well as forex. Marketscantalyst is perfect for traders that need control, flexibility and customisation.

Exness WebTerminal is browser-based, meaning you don’t need to download a thing. It is available on any device connected to the internet, and best for traders who are looking for a fast and simple way for trading. It may not be as feature-rich as MT4 or MT5, but it has every basic tool needed for executing and monitoring trades.

Exness Mobile App available for iOS and Android, traders can trade from anywhere. A practical solution for people who like to manage their accounts on the move. It also comes with minimal charting and analysis tools, which make it a good option for quick trades and checking your account balance. The mobile app allows traders to check and trade their accounts from wherever they are, anytime they want.

Trading Instruments and Markets

The Exness broker has a wide variety of trading instruments, which certainly opens up the possibilities for the trader. This diversity provides traders with an opportunity to diversify portfolios as well, which lowers the overall risk of investments made into various assets. The brief overview explains what main markets and instruments you can find on Exness — in the form of a table.

| Instrument | Number of Assets | Leverage (Up to) | Examples |

| Currency Pairs | 100+ | 1:2000 | EUR/USD, GBP/USD |

| Metals & Energy | 10+ | 1:2000 | Gold, Silver, Crude Oil |

| Indices | 30+ | 1:100 | Nasdaq 100, S&P 500 |

| Stocks | 70+ | 1:20 | Apple, Tesla, Amazon |

| Cryptocurrencies | 15+ | 1:100 | Bitcoin, Ethereum, Ripple |

Exness’s main highlight is Forex trading. Traders can access more than 100 currency pairs and can work with major, minor, and exotic pairs. The day high leverage (up to 1:2000) such that traders can control larger positions with small amount of capital. As a result beginners can start their forex journey whilst seasoned traders can benefit from the flexibility.

In addition to forex, Exness also offers metals such as gold and silver, as well as energy products such as crude oil. When the currency market sits on a seesaw, these assets are popular for hedging, a safe haven. Traders can exploit movements within the trading market with smaller investment size using leverage of up to 1:2000.

If you are interested in digital assets, you can find Bitcoin, Ethereum and Ripple on Exness. Exness offers up to 1:100 leverage for cryptocurrency trading allowing to trade these highly volatile assets for a lower investment. The cool thing about cryptos is that they are always accessible, which means traders can do all the trading they want every day.

Investors considering wider market movements can be exposed to different indices such as the Nasdaq 100 and S&P 500. Indices are a way to speculate on an entire keyboard of companies, allowing traders to follow global economic underwater trends. Exness provides leverage of 1:100 on indices which gives traders the opportunity to have greater control of their positions.

Exness also gives individual stocks on a variety of assets including apple, tesla, amazon, and other famous companies. In stock trading, traders invest in certain companies and track how they perform. Stock leverage is available in the range of 1:20; therefore, traders can manage their money more efficiently at Exness.

Spreads, Commissions, and Leverage

Exness gives traders flexibility with low spreads, reasonable commissions, and high leverage. These features make it possible to trade with a smaller investment and still control larger positions. Here’s a quick look:

- Spreads

Exness offers tight spreads, starting from 0.0 pips on accounts like Raw Spread and Zero. For the Standard account, spreads begin at 0.3 pips, keeping costs low.

- Commissions

Standard accounts have no commission. However, Raw Spread and Zero accounts charge a small fee, starting from $3.5 per lot. It suits traders that like ultra-low spreads.

- Leverage

The maximum leverage available for forex and metals is 1:2000, which allows traders to open bigger trades with a smaller amount. If it’s stocks and indices you are trading, there is leverage of up to 1:100, and if those are crypto trades, up to 1:100 leverage.

This unique combination of low costs and high leverage enables traders to manage their trades and their capital better.

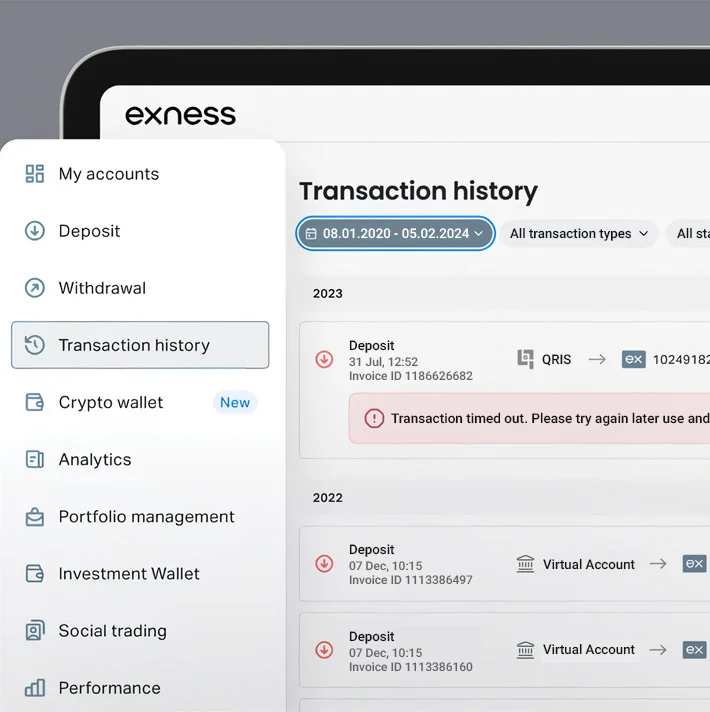

Deposits and Withdrawals

Withdrawals and deposits are straightforward and straightforward on exness. There are multiple choices for traders in Saudi Arabia and it is easy to transfer funds in and out of your account with local payment methods.

Minimum Deposit at Exness

Exness has a low minimum deposit to make trading accessible for everyone. For Standard and Standard Cent accounts, you only need $1 to start. For accounts like Pro, Raw Spread, and Zero, the minimum deposit is $500. This low starting point helps beginners get into trading without a big commitment.

How to Deposit Money to Your Account

Easy and fast deposit of funds into your Exness account.

- Go to the Exness website and sign in to your account Proceed to your personal cabinet and press the button “Deposit”

- Select a payment type such as bank transfer, credit card, or e-wallet.

- Specify the amount you wish to deposit, ensuring it complies with the minimum deposit requirement.

- We have provided the instructions necessary for you to finish the transaction.

- Depending on the payment method, your deposit should show up in your account almost immediately thereafter.

Withdrawal Methods

It does not take too long for Exness traders to withdraw funds. Withdrawal are made via wire withdrawal, e-wallet, or credit card. Almost all withdrawals are instant, but some methods depend on the service provider.

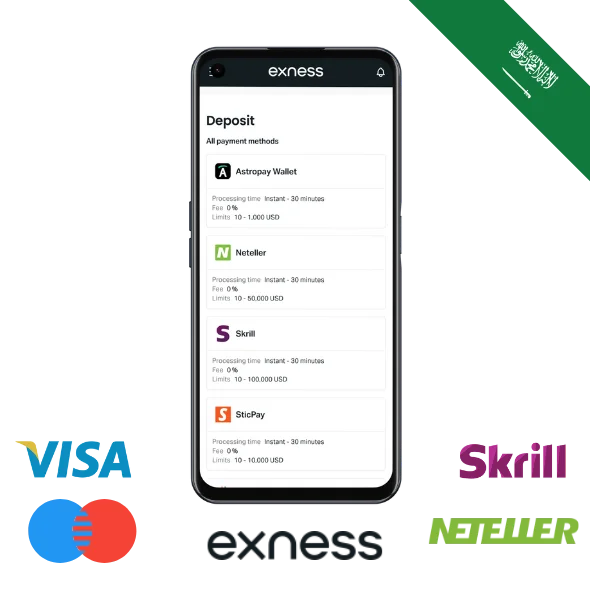

Available Payment Systems in Saudi Arabia

For traders in Saudi Arabia, Exness supports a range of convenient payment options:

- Bank Transfers: Local bank options for secure and direct transactions.

- Credit and Debit Cards: Visa and Mastercard are available.

- E-wallets: Services like Skrill and Neteller provide quick, simple transfers.

- Cryptocurrencies: Options like Bitcoin allow flexible funding and withdrawals.

These choices ensure that Saudi traders can easily deposit and withdraw funds with confidence.

Exness Social Trading

Exness Social Trading allows you to follow and mirror the trades of expert traders. So this is great for beginners that want to copy trade off of others or for someone that wants a more simple trading experience. Social Trading allows you to share information about the various trading strategies, view the success rate of each strategy, and then adopt one that aligns with your goals. When you choose a strategy, trades get copied automatically til your account.

Social Trading offers:

- Clear Information: Detailed performance stats to help you make the right choice.

- Full Control: You can decide which strategies to follow and change them whenever you want.

- Learning Opportunities: Watching successful traders helps beginners understand different strategies.

Overall, Social Trading makes trading easier and helps you learn as you go, all while using the same trusted Exness platform.

Customer Support in Arabic

This also implies that Exness traders in Saudi Arabia have the convenience of receiving customer support in their own language — Arabic. With the 24 hour service from the support team, feel free to call them anytime you need assistance. The team is 24/7 available so in case you have an question with your account, deposits, withdrawals or just a problem navigating around their platform, they are here to cure.

Here are the main ways you can contact Exness’s Arabic support:

- Live Chat: Get quick answers right from the Exness website or app. This is ideal for immediate help.

- Phone Support: Talk directly with a support agent for more detailed assistance.

- Email Support: For issues that may need more explanation or follow-up, email is a reliable option.

This easy access to Arabic-speaking support makes Exness a comfortable choice for traders in Saudi Arabia.

Exness Reviews and Reputation

Exness is widely regarded as having a trustworthy, transparent and secure trading environment by traders the world over. Exness has a reputation among traders for its low spreads, quick withdrawals, and easy-to-use platform. Here’s a look at real trader experiences, Trustpilot ratings, and awards that highlight Exness’s reputation.

Experience of Real Traders

Many traders share positive experiences with Exness. Here are a few examples:

These real experiences show that Exness is valued for its fast transactions, helpful customer service, and easy-to-use platform.

Exness Rating on Trustpilot

Trustpilot Rating The Trustpilot rating of Exness is 4.5 stars on average, which is high. This score comes from actual trader evaluations of Exness, which highlight low costs, swift withdrawals, and the best support available. Traders that use the platform comment that they like the clear fees structure and that customer support works quickly.

Some common points highlighted on Trustpilot include:

- Fast Withdrawals: Instant access to funds, which many traders find convenient.

- Clear Fee Structure: Transparent fees with no hidden costs.

- Dependable Support: Positive experiences with the Exness support team, who are helpful and responsive.

This high Trustpilot rating reflects Exness’s commitment to providing a trusted and user-friendly experience for traders.

Awards and Recognitions

Exness has won multiple awards that recognize its quality and commitment to traders. These awards are a sign of Exness’s high standards and its focus on customer satisfaction. Some of Exness’s awards include:

- Best Global Forex Broker from the Global Forex Awards.

- Most Transparent Broker by World Finance, recognizing Exness’s openness and clear communication.

- Best Customer Support from the European CEO Awards, honoring Exness’s strong support team.

These recognitions highlight Exness as a trusted, reliable broker that is committed to helping traders succeed.

Is Exness a Reliable Broker?

Yes, it is a trusted broker. Highly reputed for its reliability and safety. Regulation If you select Exness it will be a good thing to know that this broker will be based on the regulation provided and thus Exness will be rule-based regulation, and thus Exness would be required to abide by all safety features for traders and their funds. The existence of separation of clients funds and negative balance protection i.e. a trader can never lose more than what they deposit.

Furthermore, Exness safeguards users’ data and operation with all its modern technology. Whether you are a new trader or an experienced trader, a large number of traders from all over the world have praised Exness, as the most reliable and safest trader platform.

Advantages and Disadvantages of Exness

Exness has many benefits but also a few downsides. Here’s a quick look:

Advantages:

- User-friendly interfaces: MetaTrader 4, MetaTrader 5, WebTerminal, mobile applications providing a trusted and user-friendly experience for traders.

- Accessible Spreads & Fees: Enjoy competitive trading conditions with spreads as low as 0.0 pips on select accounts.

- Many types of accounts: There are accounts for nearly all levels of trading, including swap-free accounts for Islamic traders.

- Quick Deposits and Withdrawals: There are a lot of payment methods at Exness, and the majority of transfers are instant.

- Arabic Customer Support: Supports provides 24/7 support in Arabic, which comes in handy for Saudi Arabian traders.

Disadvantages:

- No Local License in Saudi Arabia: Exness is regulated internationally but does not have a specific Saudi license.

- Higher Deposit for Some Accounts: Pro, Zero, and Raw Spread accounts require a $500 minimum deposit.

- Limited Educational Resources: Exness has fewer training materials compared to some other brokers.

Overall, Exness has more positives than negatives, making it a strong choice for traders seeking a flexible and secure platform.

Frequently Asked Questions

Is Exness Available in Saudi Arabia?

Yes, Exness is available in Saudi Arabia. Traders can open accounts, access platforms, and choose account types that suit their needs. Customer support is also offered 24/7 in Arabic for convenience.

How Do I Open an Islamic Account?

To open an Islamic (swap-free) account, sign up on the Exness website, select your account type, and enable the swap-free option in settings. This option removes interest fees, aligning with Sharia principles.

What Is the Minimum Deposit?

The minimum deposit for Standard and Standard Cent accounts is $1, making it beginner-friendly. For Pro, Raw Spread, and Zero accounts, the minimum deposit is $500, designed for experienced traders.

Does Exness Support the Nasdaq 100?

Exness offers Nasdaq 100 for trading, which provides exposure to the largest U.S. tech companies in a single index.

Is Exness a Legal and Regulated Broker?

Yes, Exness is a regulated broker under supervision of authorities like CySEC and FSA and thus provides a secure and compliant trading environment for traders in Saudi Arabia.

How to Download the Exness App?

Search for Exness on your App Store or Google Play and install the Exness app. It allows you to trade/manage accounts on mobile.

How Do I Contact Customer Support?

Exness provides 24-hour Arabic support through live chat, phone, and email.

Why is Exness a great choice for traders in Saudi Arabia?

So Exness is our best choice for the traders in Saudi Arabia for several reasons, firstly they offer Islamic accounts, also they have Arabic customer support available 24/7, many trading instruments, local payment methods and relatively low spreads.